Table of Contents

Introduction

2022 was a very interesting year for us here at Puget Systems. Not only did the supply of hardware stabilize significantly over the course of the year, but we also had a number of major products launch either during 2022, or at the very tail-end of 2021, including:

- Windows 11 (Q4 2021)

- Intel Core 12th Gen (Q4 2021)

- NVIDIA GeForce RTX 3090 Ti (Q2 2022)

- AMD Threadripper PRO 5000-WX Series (Avail. Q3 2022)

- AMD Ryzen 7000 Series (Q3 2022)

- Intel Core 13th Gen (Q3 2022)

- Intel Arc GPUs (Q4 2022)

- NVIDIA GeForce RTX 4080/4090 (Q4 2022)

That is a LOT of product releases in a relatively short period, and many of them caused big shifts in what hardware we ended up selling to our customers.

Today, we want to take a step back and examine our overall sales trends for various hardware categories in 2022. This is a follow-up to the “Hardware Trends of 2021” we published a year ago, although there are some differences in how we compiled the data that we wanted to clarify. The big change is that instead of listing the data by total unit sales, we are instead doing it per order. We have a number of customers who purchase large quantities of systems, and some of those tend to be somewhat unusual configurations. Since we are looking at trends in this post, we wanted to filter out those large orders as they can otherwise cause random large spikes in the data.

Before we begin, we want to clarify that this data represents our workstation sales at Puget Systems and is not indicative of the computer industry at large. We focus on high-end workflows for content creation, engineering, and scientific computing, which often have very different priorities than gaming or general home/office systems. With that explained, let’s jump into the data!

CPU (Processor)

Starting off with the CPU, we decided to divide the data into two groups: “Client” processors (including AMD Ryzen and Intel Core), and “Workstation” processors (AMD Threadripper/Threadripper PRO and Intel Xeon). The term “Client” is a bit of a misnomer these days, as Ryzen and Core CPUs are very commonly used in workstations, but we wanted to separate out these classes of processors since they have very different capabilities and price points.

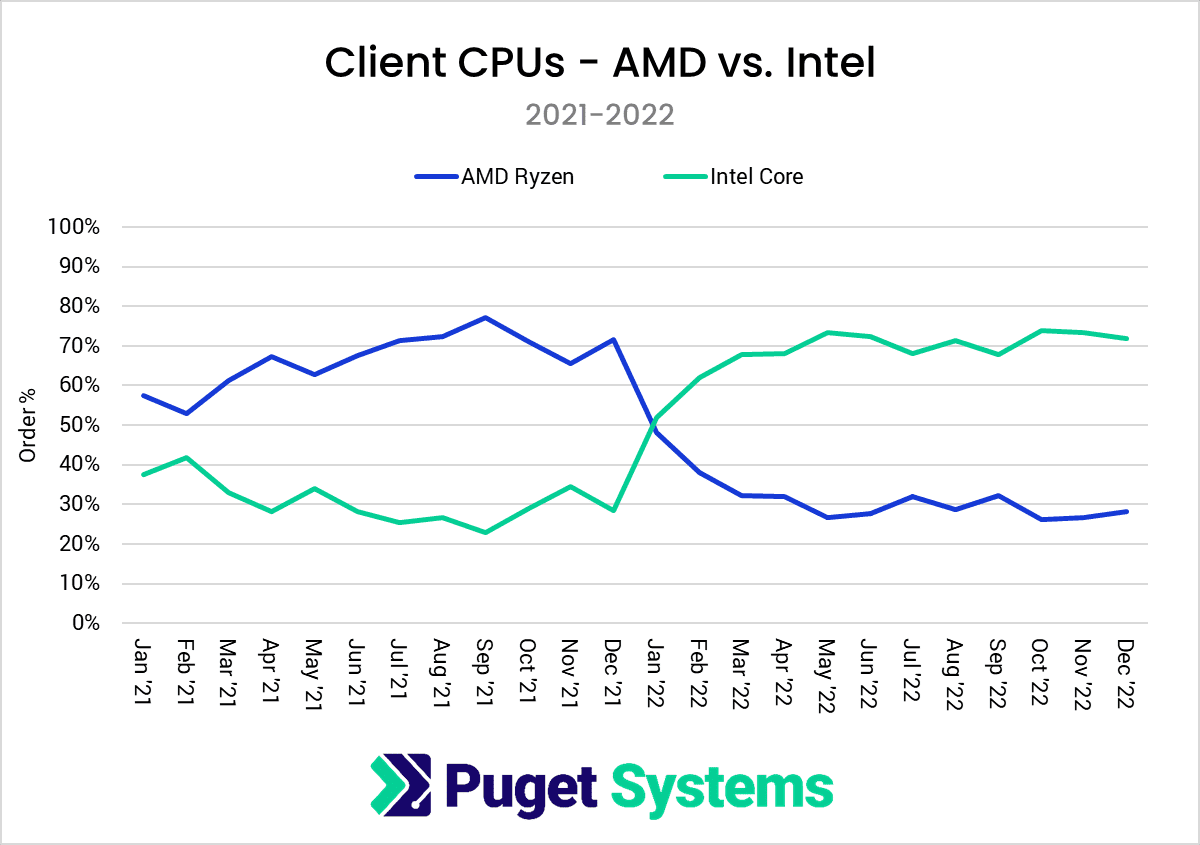

In order to properly appreciate the CPU sales trends in 2022, we decided to go all the way back to the start of 2021. At the end of 2021, Intel released the Intel Core 12th Gen processor family, which, as we showed in our review, catapulted Intel in front of AMD for a wide variety of workflows. It took a few months for motherboards to shake out and supply to stabilize fully, but the end result was almost a complete flip of AMD Ryzen and Intel Core sales from the previous year. Instead of AMD Ryzen comprising more than 70% of our client CPU sales in 2021, Intel Core ended up with over 70% of our client CPU market share.

AMD did release their Ryzen 7000 processor line in Q3 of 2022, which closed the performance gap almost entirely, but Intel launched their own Core 13th Gen processor line only a short time later. The end result was almost a “canceling out” of both product lines in terms of relative performance gain, with no major shift in relative client CPU sales between the two brands.

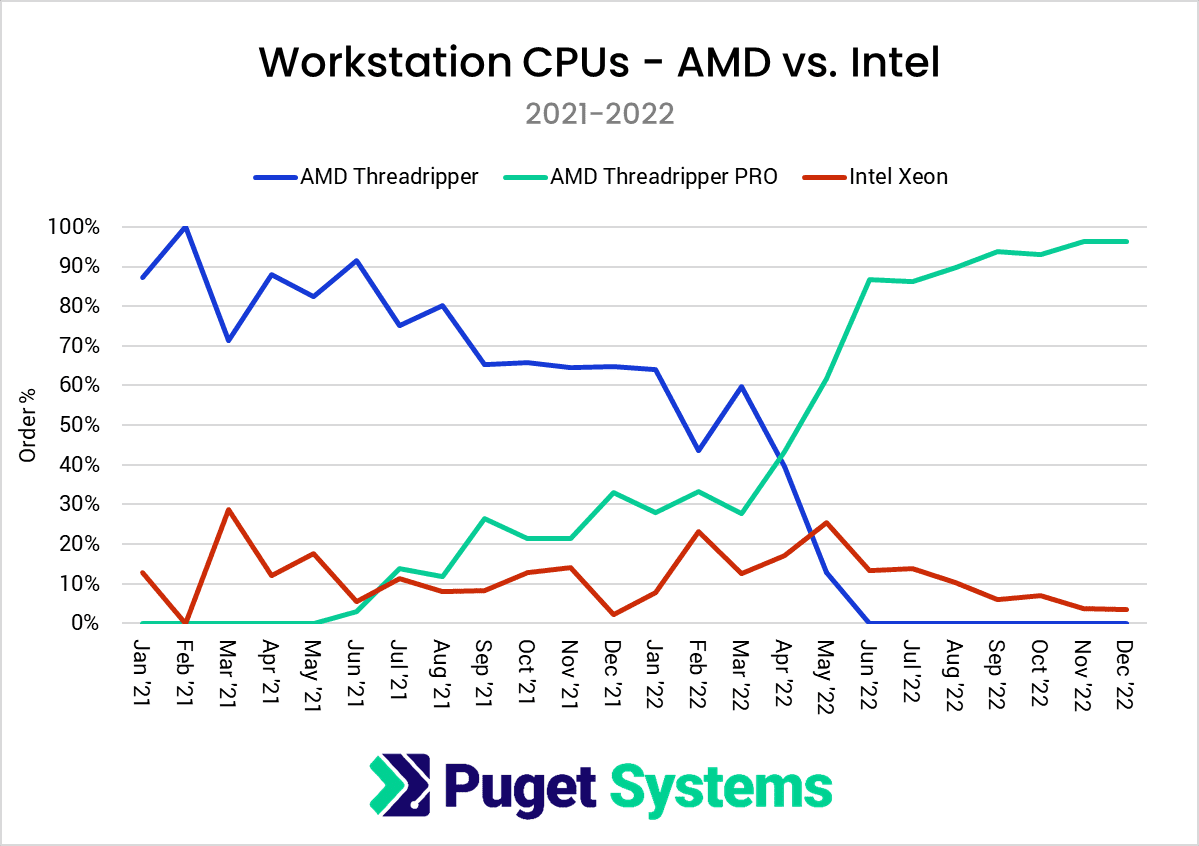

While Intel ended with a firm lead for client CPUs in 2022, AMD ended up with an even stronger lead for workstation processors.

There are a couple of very interesting things to point out in the chart above. The first is that while AMD’s Threadripper PRO line has been out since early/mid-2021, 2022 was when we completed our shift from Threadripper to Threadripper PRO. However, this wasn’t something we did voluntarily, as AMD opted to discontinue their normal Threadripper line with the 3000 series. You can still find them available online, but when the updated AMD Threadripper PRO 5000 WX-Series processors became available in Q3 2022, the older Threadripper CPUs couldn’t keep up, and we made a choice to drop them. This was a move we made over several months, but you can clearly see how Threadripper PRO took over all the sales of Threadripper by June 2022.

Alongside the rise of Threadripper PRO, we also saw a bit of a decrease in Intel Xeon sales in 2022. Intel Xeon hasn’t been a big seller for us since AMD launched their Threadripper line, and due to the terrific performance and stability of the latest Threadripper PRO processors, by the end of 2022, Xeon only made up about 5% of our workstation CPU sales. Conversely, that means AMD ended up with a massive 95% market share in this segment.

Overall, including both client and workstation CPUs, we ended 2022 with nearly an equal split between Intel and AMD CPUs in our workstations. Almost all of the Intel sales were for the Core processors, while AMD was fairly evenly split between Ryzen and Threadripper PRO.

GPU (Video Card)

Because of our focus on content creation, engineering, and scientific computing, we use NVIDIA GPUs almost exclusively in our workstations. That is something we hope changes in the future, because competition is always better for the consumer, but for now AMD can’t keep up with NVIDIA in terms of performance and stability for our target workflows.

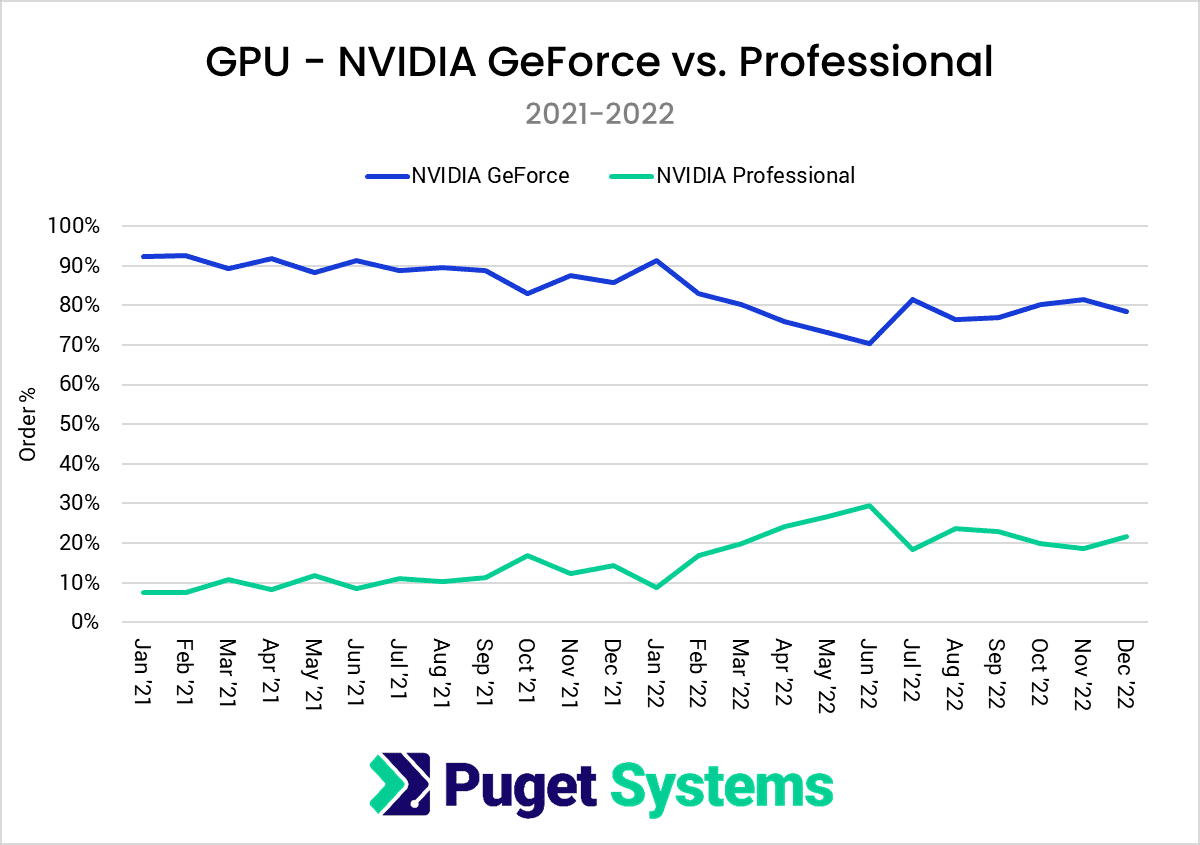

What we can do, however, is look at how our GPU sales break down between NVIDIA’s consumer-oriented GeForce line and their Professional (NVIDIA RTX, formerly Quadro) line.

Once again, we are going to include data going back to January of 2021 to provide some additional context. Overall, the big trend is that we are seeing a growing market share for professional GPUs over the last few years, and it accelerated a bit in 2022. Where GeForce used to be over 90% of our GPU sales, we ended 2022 at only 80%.

This isn’t a massive shift, but it is interesting that it is such a slow, consistent change over many years. The underlying cause is multi-faceted and hard to pin down completely, but we attribute it to two main factors:

- GeForce cards are increasingly poor choices for multi-GPU configurations due to the lack of blower-style coolers and limited NVLink support.

- As a company, we have seen larger growth in workflows ideal for Professional cards, including virtual production and AI development.

We don’t expect GeForce and RTX cards to have parity in our workstations any time soon, but it is interesting to see the slow shift over time. Whether this trend continues, however, is very hard to predict.

Storage

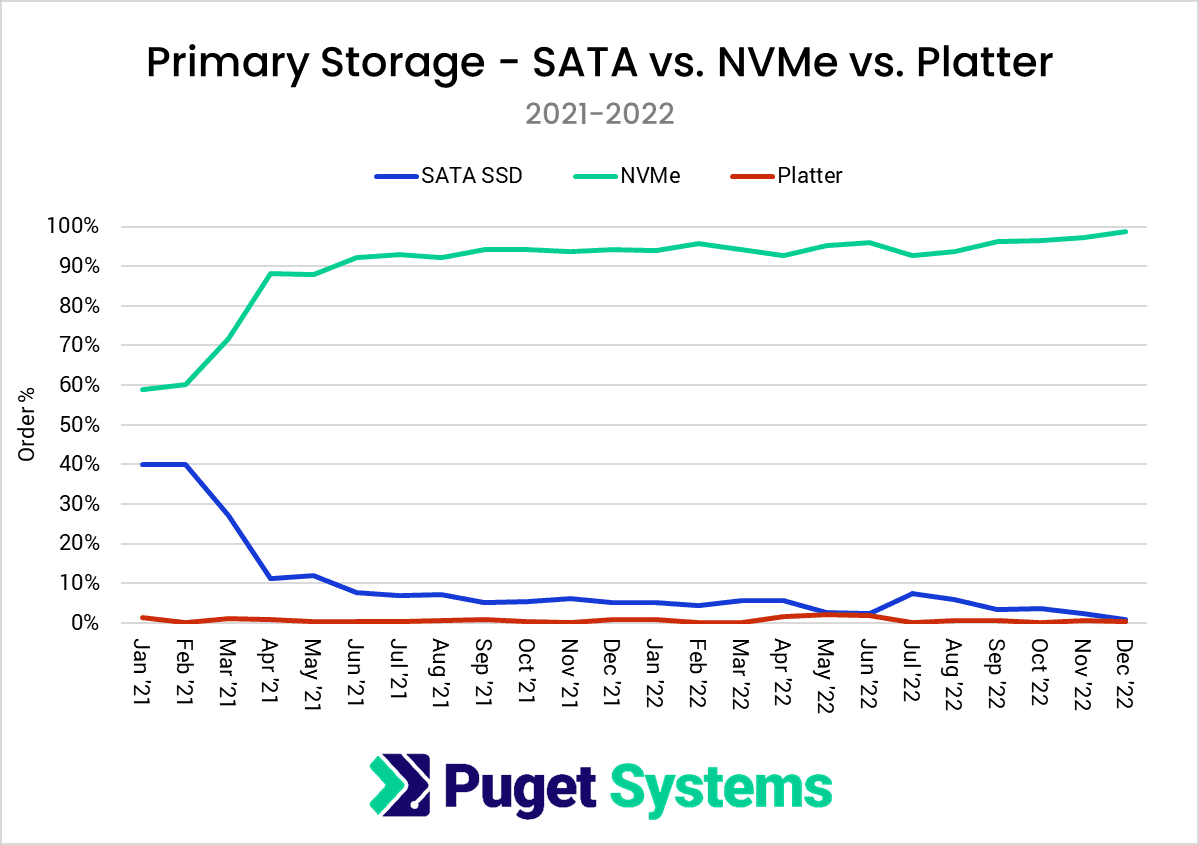

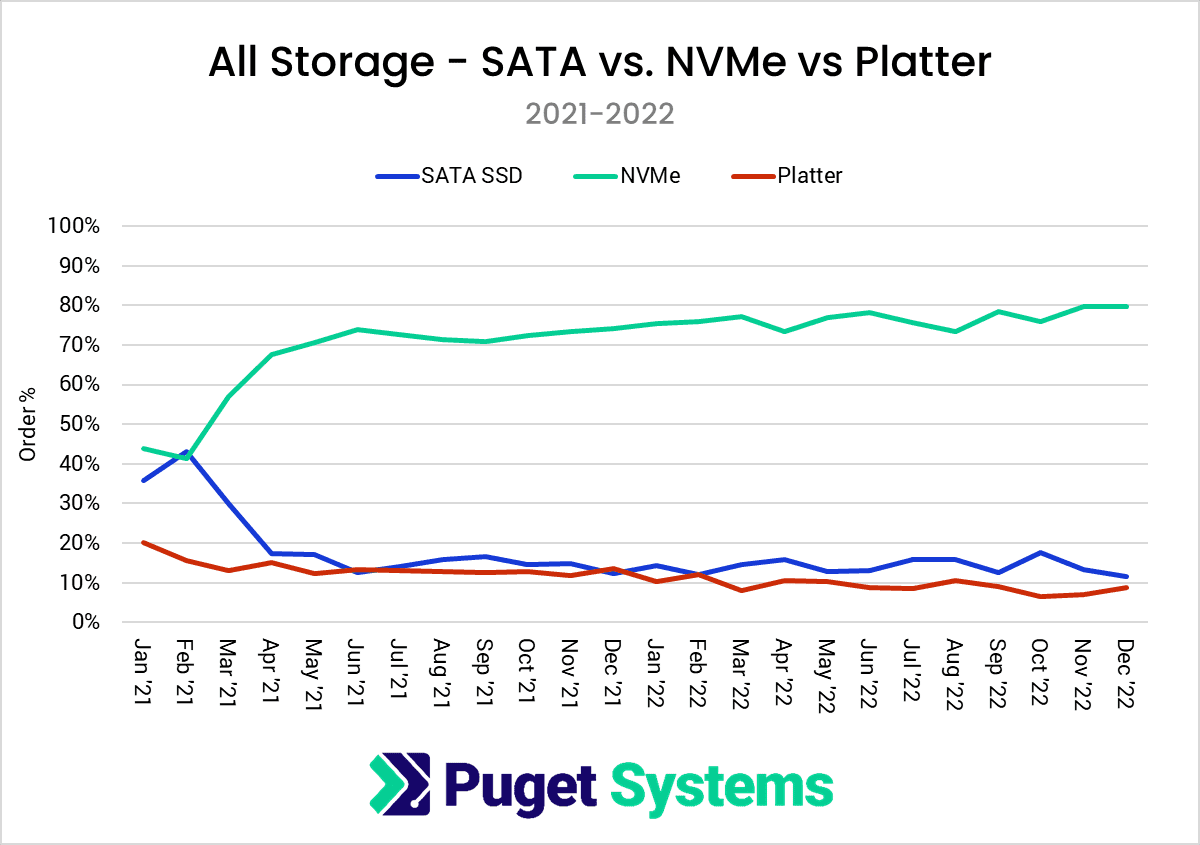

For storage, we are mainly interested in how our usage of NVMe, SATA SSD, and platter drives changed in 2022. However, because many of our systems ship with just one drive while others have two, three, or more drives, things get very messy quickly. So, to start, we are going to limit the data to just the primary drive, then look at the data across all the drives we have sold in our systems.

Overall, 2022 was very stable as far as what type of drive we used for the primary OS drive in our systems. 2021 saw some big changes due to the availability of more cost-effective NVMe drives, but by the start of 2022, we were already using NVMe drives as the primary drive in 95% of our systems. The only change that has happened since then is that NVMe usage has grown to nearly 100%. This is largely due to the fact that at smaller capacities (1TB and less), NVMe drives are only a few dollars more than a SATA SSD.

Switching to overall drive usage, NVMe drives are still the dominant option, but SATA SSD and platter drives are managing to hang on. We ended 2022 with SATA SSD and platter drives only making up about 10% of our total drive sales each, which is only slightly down from where we started the year.

Until the larger (4TB+) NVMe drives come down in price, we don’t expect SATA SSD sales to disappear completely. And it will be even longer before they are able to match the sheer value of platter drives when it comes to mass storage.

OS (Operating System)

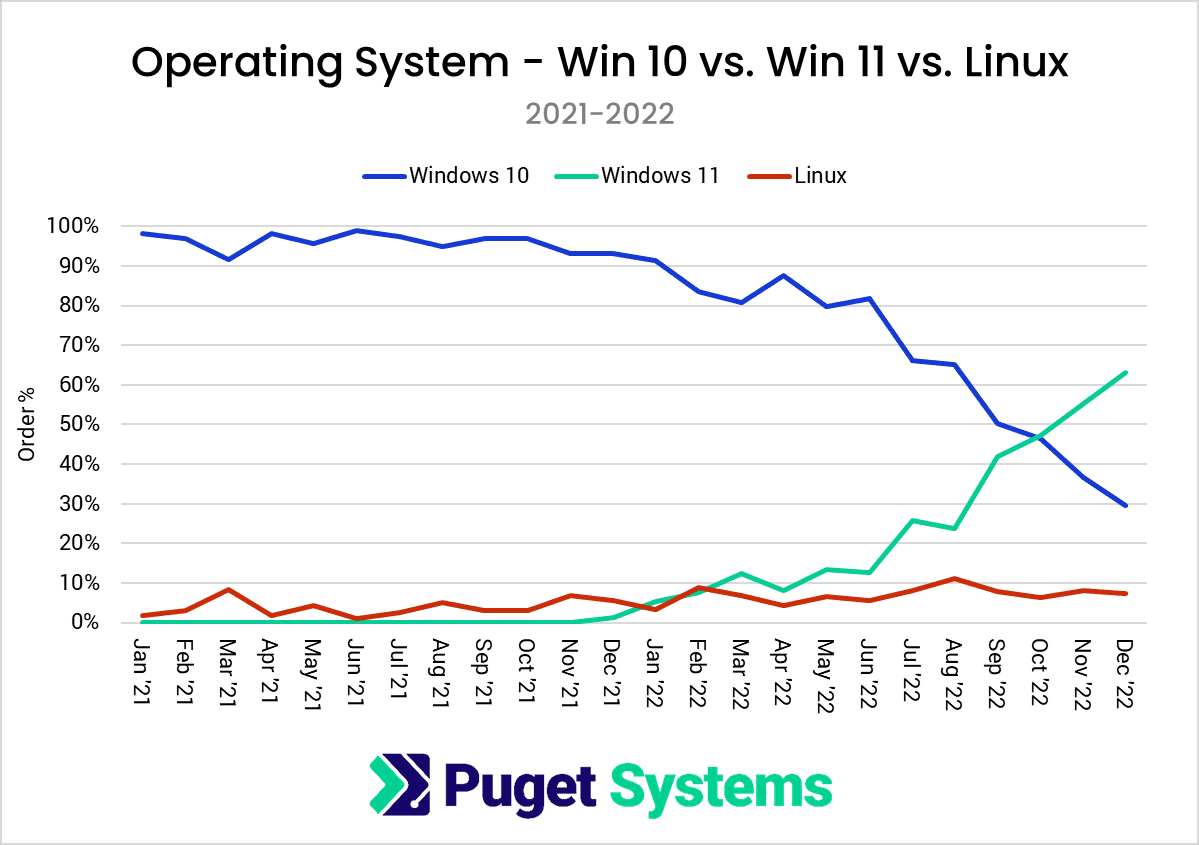

While not hardware, we also wanted to include the OS in this post, as the move from Windows 10 to Windows 11 in particular was very interesting.

When Windows 11 launched at the end of 2021, there were significant issues with application compatibility. Some applications simply didn’t work, while others saw performance degradation on the newer operating system. It wasn’t until the end of July 2022 that support was good enough that we were comfortable making Windows 11 the default option on most of our systems, which was nearly 9 months after its official launch.

You can clearly see these milestones on the chart above. Slow adoption of Windows 11 at first, with a sharp increase around July 2022 as we became confident in the OS for the workflows we target. Even then, however, it wasn’t until October 2022 that Windows 11 passed Windows 10 as the most common OS used on our systems.

Today, we have very few reservations about Windows 11, but we still have a significant number of customers who prefer Windows 10. And in fact, Windows 11 adoption has actually slowed down since the end of 2022. It is still growing, but as of March 2023, Windows 11 is used on just 70% of our systems.

Conclusion

Overall, 2022 was a very interesting year for us here at Puget Systems. Within 2022 itself, a lot of things were fairly stable in terms of market share, but there were a number of launches at the very tail end of 2021 that had a big impact on what we sold to our customers compared to the previous year.

To summarize some of the bigger trends:

- In 2022, Intel took the lead in the client CPU space for us, completely flipping our ratio of AMD Ryzen and Intel Core CPUs from the previous year. However, AMD didn’t budge in the workstation space, with Threadripper PRO sales outpacing Intel Xeon by nearly 20:1.

- GPU and storage sales were fairly consistent: market share for the NVIDIA RTX cards increased a bit relative to GeForce, but NVMe drives continue to dominate for storage.

- Lastly, Windows 11 was (and continues to be) a slow burn, taking almost a year after launch for it to pass Windows 10 in terms of market share.

The question now is how 2023 is going to shape up. We are in the middle of Intel’s launch of their Xeon W-2400 and W-3400 processor families right now, which could allow Intel to make a resurgence in the workstation CPU space. At the same time, new CPUs from AMD are always on the horizon, as well as new GPUs from NVIDIA, AMD, and Intel. Will 2023 be a stable year, or will we see some major shifts? If you want to make any predictions, do so in the comments below!